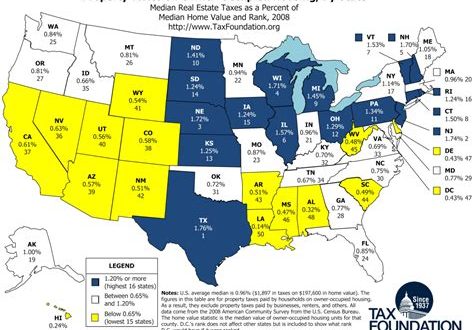

When looking to buy property, there is no doubt that the tax burden is one of the most important considerations. The cost of property taxes can vary widely between different states, and understanding which states have the lowest property taxes can help you make the best decision for your budget.

The states with the lowest property taxes in the United States are Hawaii, Alabama, Louisiana, Colorado, and South Carolina. In fact, Hawaii has the lowest property taxes of any state in the nation, with an effective property tax rate of only 0.26%. Alabama and Louisiana both have effective property tax rates of 0.51% while Colorado and South Carolina have effective property tax rates of 0.53% and 0.57%, respectively.

When looking at each state’s individual property tax rates, it’s important to keep in mind that some states may have a lower overall rate but the taxes may be higher for certain counties or cities. For example, in Alabama, the property tax rate is 0.40%, but it can be as high as 1.50% in certain counties. It’s important to research each state’s individual rate to get a better understanding of the taxes you will be responsible for.

In addition to looking at a state’s overall property tax rate, you should also consider the median property tax paid in each state. The median property tax paid in Hawaii is only $917, while in Alabama it is $589. Louisiana has a median property tax of $659, Colorado’s is $1,283, and South Carolina’s is $1,094.

When deciding on which state to purchase property in, there are many factors to consider beyond just the property tax rate. However, understanding the property taxes for each state can help you make a more informed decision. The states with the lowest property taxes in the U.S. are Hawaii, Alabama, Louisiana, Colorado, and South Carolina, and they all have effective property tax rates below 1%.

Where Can Homeowners Find The Cheapest Property Taxes In The United States?

With the real estate prices on the rise, many people who are looking to purchase a home are looking for ways to save money. One of the biggest expenses associated with buying a home is property taxes, so it’s important to know where you can find the cheapest property taxes in the United States.

While property taxes can vary significantly from state to state, there are a few states that have consistently low property taxes. The states with the lowest property taxes in the US include:

- Alaska

- Hawaii

- Delaware

- Idaho

- Montana

- Oregon

- Arkansas

- Tennessee

- Oklahoma

These states have some of the lowest property tax rates in the US, with Alaska having the lowest rate of 0.29%, followed by Hawaii at 0.36%. Delaware has the third-lowest rate at 0.57%, while Arkansas has the fourth-lowest rate at 0.60%. Idaho, Montana, and Oregon all have property tax rates of less than 1%. Arkansas and Tennessee have rates of 0.77% and 0.79%, respectively, while Oklahoma has the highest rate of the states listed at 0.96%.

It’s important to note that these rates can vary significantly from county to county within a state, so it’s important to research the property tax rates in the area you’re looking to buy in before making a decision.

To get an accurate picture of the property taxes in your area, it’s best to consult with a local real estate agent or a tax professional. They can provide you with the most accurate information and help you make an informed decision about where to purchase your home.

Which States Have The Lowest Property Taxes In The US?

When it comes to owning property in the US, property taxes can be a significant expense. Depending on where you live, you could be paying thousands of dollars in property taxes each year. But there are some states that have much lower property taxes than the national average. So which states have the lowest property taxes in the US?

The states with the lowest property taxes in the US are Hawaii, Alabama, Louisiana, South Carolina, and Delaware. Hawaii has the lowest property taxes, with an average tax rate of 0.27%. Alabama has an average property tax rate of 0.43%, while Louisiana has a rate of 0.48%. South Carolina’s average rate is 0.51%, and Delaware’s is 0.57%.

The states with the highest property taxes are New Jersey, Illinois, Texas, New Hampshire, and Vermont. New Jersey’s average rate is 2.35%, while Illinois is 2.32%. Texas’ average rate is 2.17%, and New Hampshire’s is 2.06%. Vermont has the highest property taxes in the US, with an average rate of 1.89%.

The national average for property taxes is 1.08%. California has an average rate of 0.77%, and New York’s is 1.60%. Other states that have relatively low property taxes include Arizona (0.72%), Florida (0.98%), and North Carolina (0.87%).

Below is a table showing the average property taxes in each state:

| State | Tax Rate (%) |

|---|---|

| Hawaii | 0.27 |

| Alabama | 0.43 |

| Louisiana | 0.48 |

| South Carolina | 0.51 |

| Delaware | 0.57 |

| Arizona | 0.72 |

| California | 0.77 |

| Florida | 0.98 |

| North Carolina | 0.87 |

| New York | 1.60 |

| New Jersey | 2.35 |

| Illinois | 2.32 |

| Texas | 2.17 |

| New Hampshire | 2.06 |

| Vermont | 1.89 |

So if you’re looking for the states with the lowest property taxes in the US, Hawaii, Alabama, Louisiana, South Carolina, and Delaware are your best bets. On the other hand, if you’re looking for states with higher property taxes, you should consider New Jersey, Illinois, Texas, New Hampshire, and Vermont.

Road Topic Tourism & Travel

Road Topic Tourism & Travel